RevOps for Finance Businesses - Quantum FS Case Study

Because theory is not enough...

Quantum Financial Strategies - overview of business information

Preliminary Note

While there is a lot of theory around RevOps, it's very important to take a step further and take a look at representative examples to understand the real value of this strategy.

This is the case of Quantum FS. Don't Google its name, you won't find it. It would be weird to show here a real case scenario 🫠... the purpose of this Blog is not to show how to set up operations and processes of a Finance company. The Mission of this Blog is to help, providing Representative Case Studies that exemplify the enormous benefit that RevOps can bring to businesses in this industry to exponentially increase their revenues.

Enjoy it!

Business Description

Quantum FS was founded in 2005 by a group of finance industry experts who saw a need for more flexible and accessible working capital loans for small and medium-sized businesses. Based in Montreal, Quebec, Canada, Quantum FS started as a small company with a handful of employees and a mission to provide innovative financial solutions to businesses in need.

In its early years, Quantum FS faced many challenges, including fierce competition from established lenders and a difficult economic environment. However, the company persevered by leveraging its expertise, developing strong relationships with customers, and continuously innovating its products and services.

Over the years, Quantum FS has grown into a respected player in the finance industry, with a reputation for providing flexible, personalized, and accessible working capital loans. The company has expanded its reach beyond Montreal to serve customers across Canada and has plans to expand into the United States in the near future.

Despite its growth, Quantum FS has remained true to its mission of helping businesses succeed by providing the financing they need to grow and thrive. The company has always maintained a customer-centric approach, focusing on building long-term relationships with customers and delivering exceptional customer service at every stage of the customer journey.

The company's mission is to help businesses succeed by providing the financing they need to grow and thrive.

Its values: transparency, integrity, and collaboration in all its dealings with customers, employees, and partners. The company strives to build long-term relationships with customers based on trust and mutual respect.

The company's vision is to be the leading provider of working capital loans in North America. Capital Solutions Inc. aims to achieve this vision by continuing to innovate its products and services, leveraging technology to streamline its operations, and expanding its reach to new markets and customer segments. The company is committed to delivering exceptional customer service and building a culture of excellence and continuous improvement.

Main Revenue Metrics

- Sales Revenue: $1,000,000 per year

- Net Profit Margin: 10%

- Gross Margin: 30%

- Monthly Recurring Revenue: $50,000

- Net Promoter Score: 6/10

- Qualified Leads Per Month: 50

- Lead-to-Client Conversion Rate: 25%

- Monthly Website Traffic: 1,000 visitors

- Customer Acquisition Cost: $1,500

- Customer Lifetime Value: $25,000

- Net Customer Worth: $10,000

Revenue Growth Goals

- Increase Sales Revenue: Increase annual sales revenue by 20% to $1.2 million within the next 12 months.

- Improve Net Promoter Score: Increase Net Promoter Score (NPS) by 1 point to 7/10 within the next 6 months.

- Increase Qualified Leads: Increase the number of qualified leads per month by 50% to 75 within the next 3 months.

- Improve Lead-to-Client Conversion Rate: Increase lead-to-client conversion rate by 5% to 30% within the next 6 months.

- Increase Monthly Website Traffic: Increase monthly website traffic by 30% to 1,300 visitors within the next 6 months.

- Reduce Customer Acquisition Cost: Reduce customer acquisition cost by 10% to $1,350 within the next 3 months.

- Improve Customer Lifetime Value: Increase customer lifetime value by 15% to $28,750 within the next 12 months.

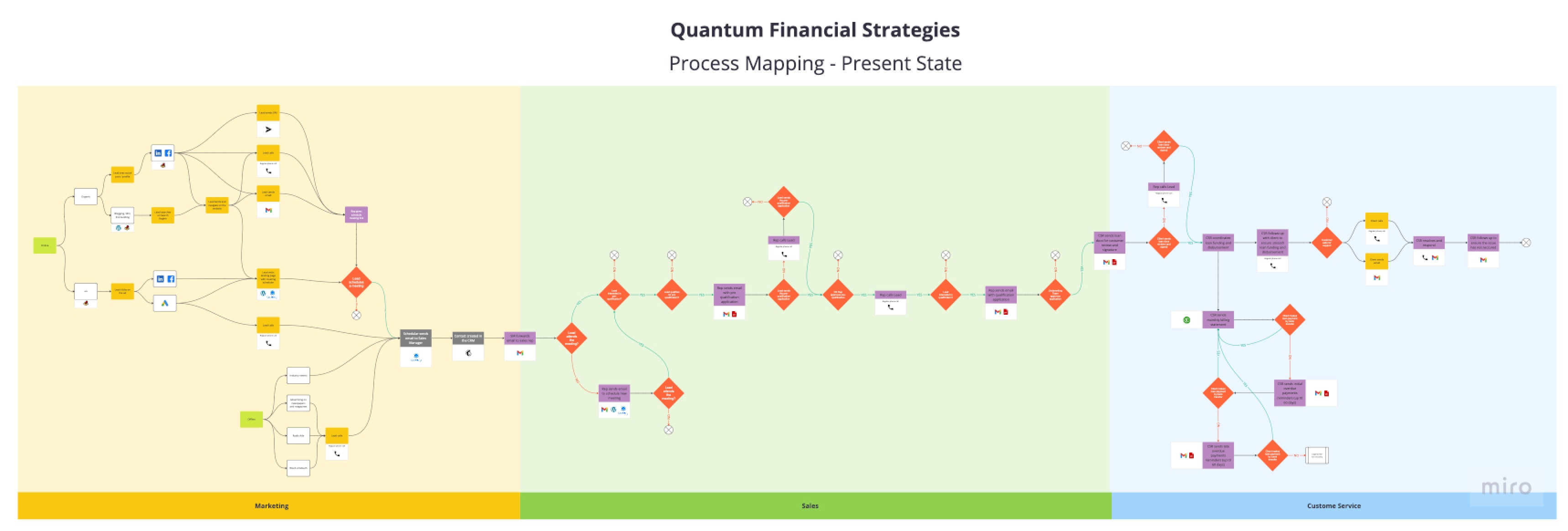

I. - Process Mapping: Present State

At Quantum FS they knew well how, what for and why they were doing their processes. After all, they are now a major player in Montreal's finance industry.

However, they lacked a synthesized view of their operations and processes. By creating this process map we have been able to identify frictions, bottlenecks and excellent optimization opportunities to do the same, but with more and better, using fewer resources.

We have also identified opportunities to expand lead generation opportunities and improve the quality of communication with leads through automated and personalized ways.

Yes, the map images have low quality.

Access the Full High-Quality FREE Version!

In the Full Version we use the Miro embed board tool. Play without limitations with the viewing!

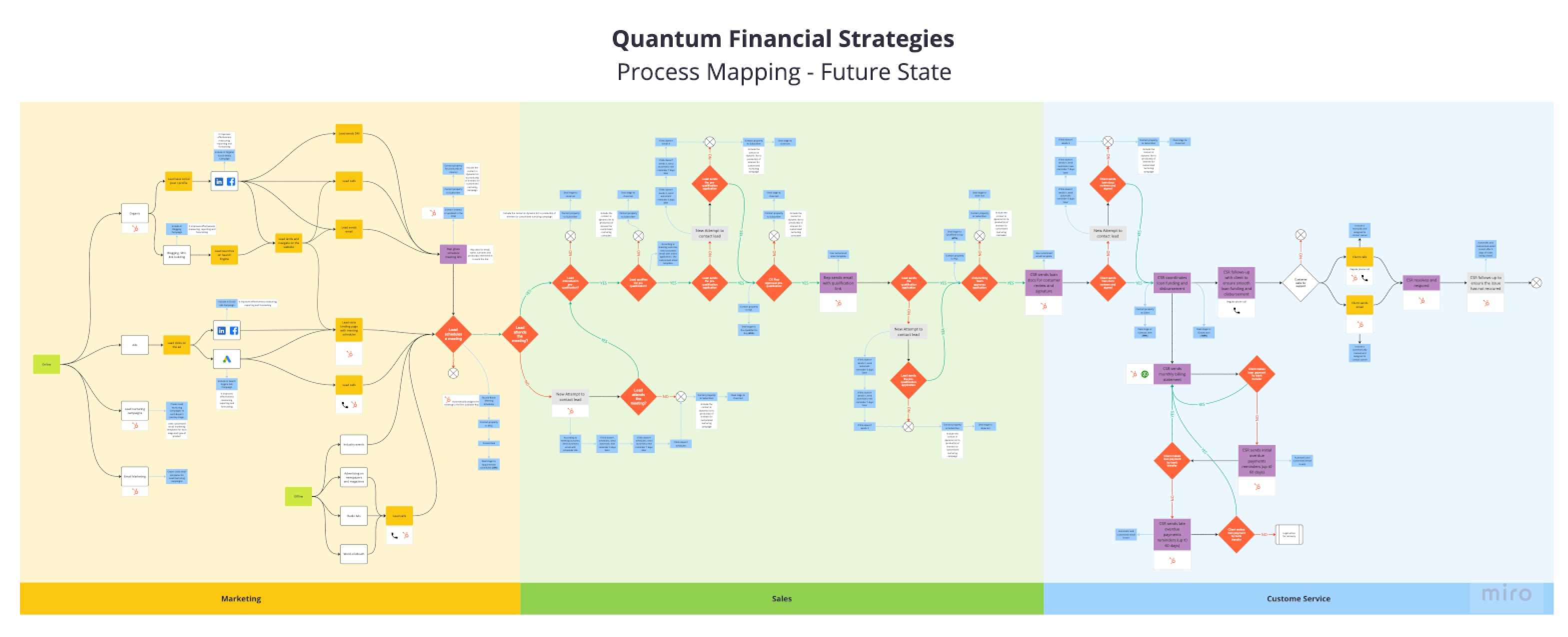

II.1 - Process Mapping: Future State

Access the Full FREE Version NOW!

it's not Frimium... it's really Free... *

* Be a racoon, not a cat.

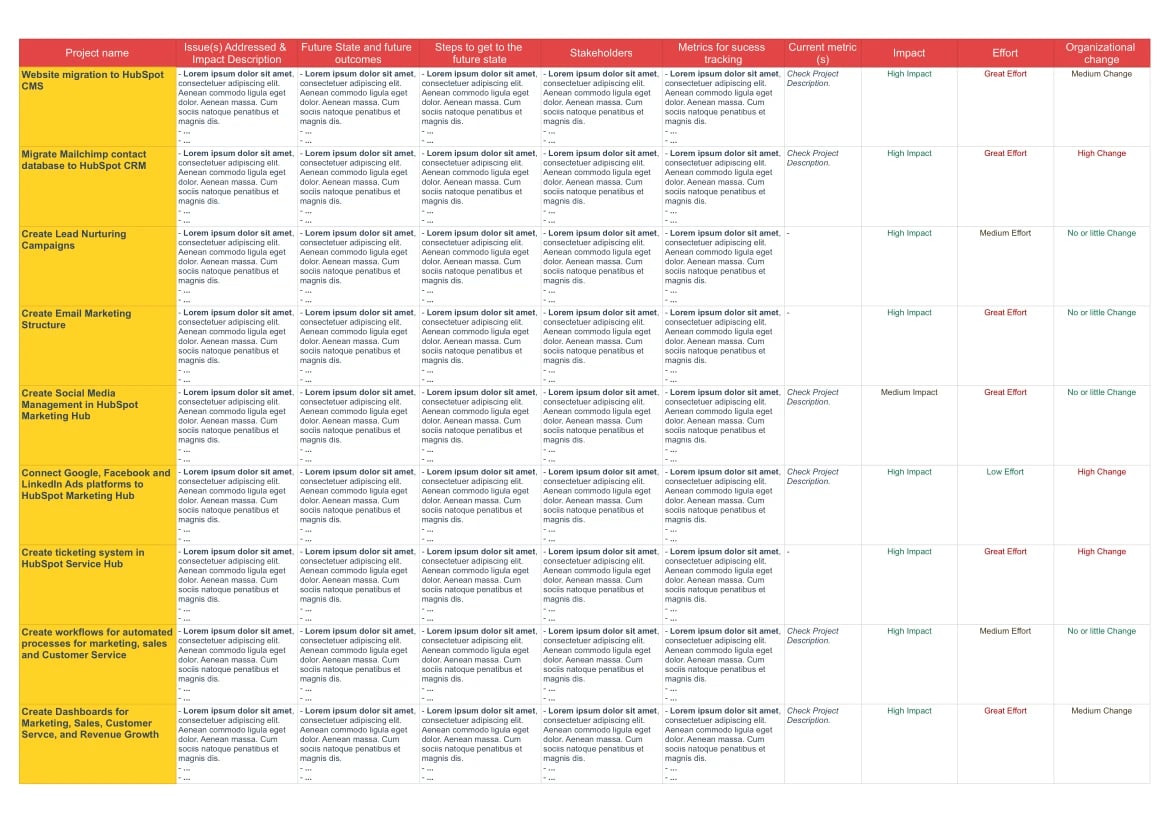

II.2 - Projects Listing and Prioritization Examples

If you don't understand the impact, effort and organizational change classification for prioritizing projects and tasks, don't worry, it's normal. It still happens to me sometimes 😅. Check the "Prioritization and Planning" section, in the menu, under "How to do RevOps".

Yes, the table is really very, very "lorem ipsum".

Access the Full FREE Content!

In the Full Version we share a Google Sheet embed version. Feal free to copy-paste!

III. - Reporting and Dashboards Examples

IIn this section, our focus is on demonstrating the performance and value of RevOps efforts, rather than creating reports and dashboards with every single KPI of each operational area such as Marketing, Sales, and Customer Service. We will focus on metrics that are meaningful to the revenue growth goals and to the business expectations when starting with RevOps.

For example, we'll only discuss the monthly organic traffic increase in this section if it was a primary goal with direct impact on revenue growth. Otherwise, we will leave this metric in another place, such as the web analytics dashboard reports.

You can also check other examples of RevOps applied to the finance and insurance industry.

NOTE: Part of the resources and methods used here are partially based in the materials offered at the HubSpot Academy's RevOps Bootcamp (first edition, Winter 2023). As I always say whenever I have the chance: this training, more than a bootcamp, it was a boostcamp for me. It has shown me so much and changed so much the way I approach RevOps! To everyone who wants to learn how to do it professionally: leave this blog immediately and sign up for the next edition. Afterwards you can come back here whenever you want!

If you have any questions or would like more information, do not hesitate to contact me! You can find the contact page in the menu!